What is Risk Analysis?

Risk Analysis is the process of identifying, assessing, and prioritizing potential threats to an organization’s data, operations, or systems. It involves evaluating the likelihood and impact of different risks—ranging from cyberattacks and regulatory non-compliance to operational failures and data breaches—and informing strategies to mitigate or eliminate those risks.

In modern enterprises, risk analysis is data-driven, continuous, and tightly integrated with cybersecurity, governance, and compliance programs. It’s no longer just a checklist—it’s a strategic discipline essential to digital resilience and decision-making.

Risk Analysis as a Competitive Advantage in the Age of AI, Cyber Threats, and Regulatory Scrutiny

As enterprises become increasingly reliant on AI, cloud infrastructure, and decentralized data ecosystems, traditional approaches to risk management are no longer enough. Risk analysis today must account for not only known threats but emerging vulnerabilities from dynamic sources like unstructured data, algorithmic decisions, and evolving regulations.

AI models, for example, can amplify risks if trained on biased or unverified data. Unstructured data can hide sensitive information that violates compliance laws. And third-party ecosystems can introduce supply chain risks that ripple across operations. In this context, real-time, intelligent risk analysis helps organizations stay ahead—not by avoiding risk entirely, but by understanding it deeply and responding proactively.

Leading organizations are integrating AI and machine learning into their risk analysis frameworks, enabling predictive insights, automated threat detection, and faster decision-making. Combined with policy-based governance and secure architectures, this approach transforms risk analysis from a reactive process into a proactive advantage, fueling trust, resilience, and innovation.

Challenges in Enterprise Risk Analysis – and What to Do

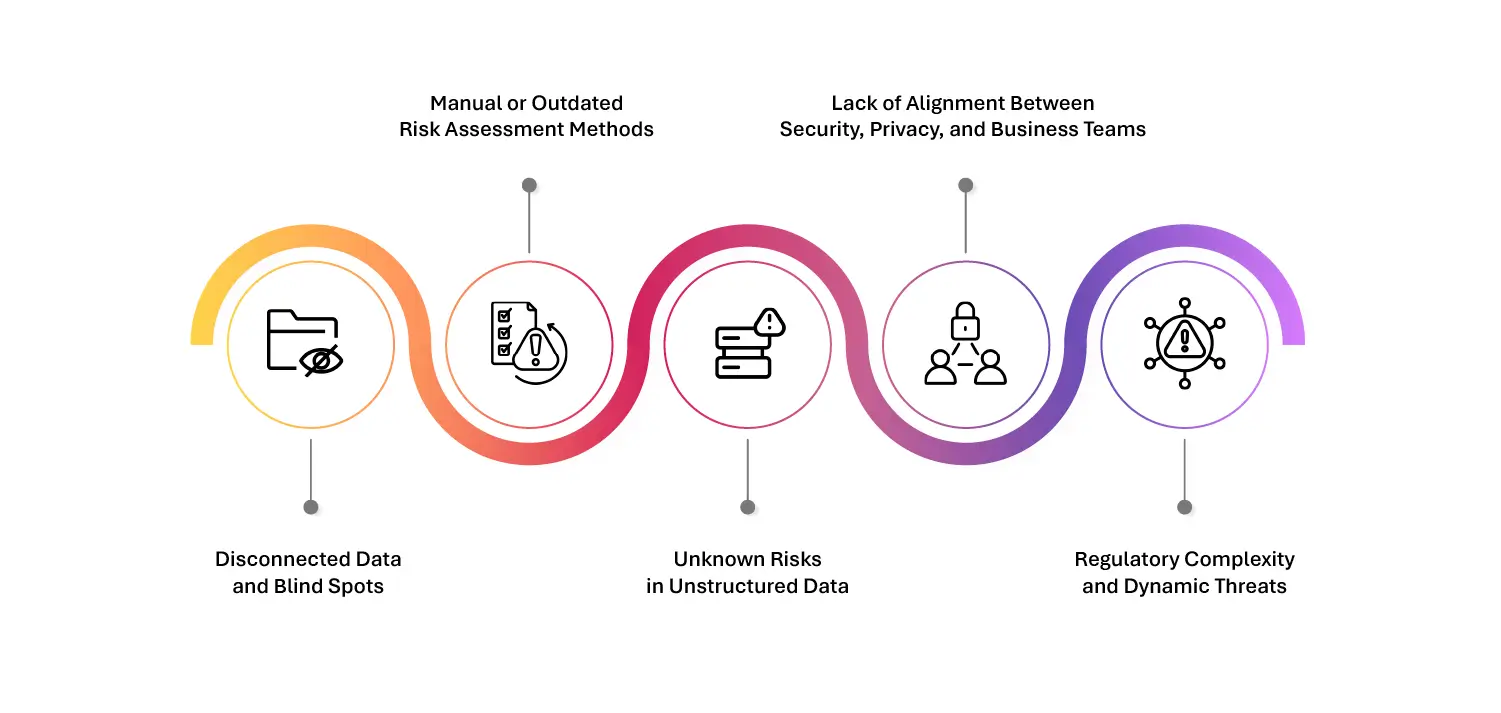

Disconnected Data and Blind Spots

Risk-relevant data is often siloed across systems, business units, and geographies, making it hard to gain a unified view.

What to do:

Implement a centralized risk analytics engine that pulls from structured and unstructured sources, enabling holistic visibility and correlation.

Manual or Outdated Risk Assessment Methods

Static assessments can’t keep pace with fast-moving threats or real-time compliance requirements.

What to do:

Automate assessments using AI/ML to continuously monitor risk signals, such as access anomalies, policy violations, or data misuse.

Unknown Risks in Unstructured Data

Dark data—files, emails, recordings—often hides sensitive or non-compliant information that is overlooked in traditional scans.

What to do:

Deploy intelligent discovery tools that classify and analyze unstructured data to expose hidden risks and inform governance.

Lack of Alignment Between Security, Privacy, and Business Teams

Risk analysis often happens in silos, leading to miscommunication and delayed response.

What to do:

Adopt federated governance frameworks and shared metrics that align cybersecurity, compliance, and operations teams around common risk thresholds.

Regulatory Complexity and Dynamic Threats

New laws and sophisticated cyberattacks evolve faster than manual response processes can handle.

What to do:

Integrate real-time compliance monitoring and automated alerting into your risk analysis workflow. This allows your organization to adapt instantly to changing conditions.

Risk analysis isn’t just about defense—it’s about foresight. In an era defined by intelligent systems, real-time decision-making, and increasing accountability, organizations must treat risk analysis as a living, learning process. Done right, it empowers enterprises to move fast without breaking trust, turning uncertainty into a competitive edge.

Getting Started with Data Dynamics:

- Learn about Unstructured Data Management

- Schedule a demo with our team

- Read the latest blog: Sovereign AI and the Future of Nations: Why Data, Infrastructure, and Intelligence Must Align