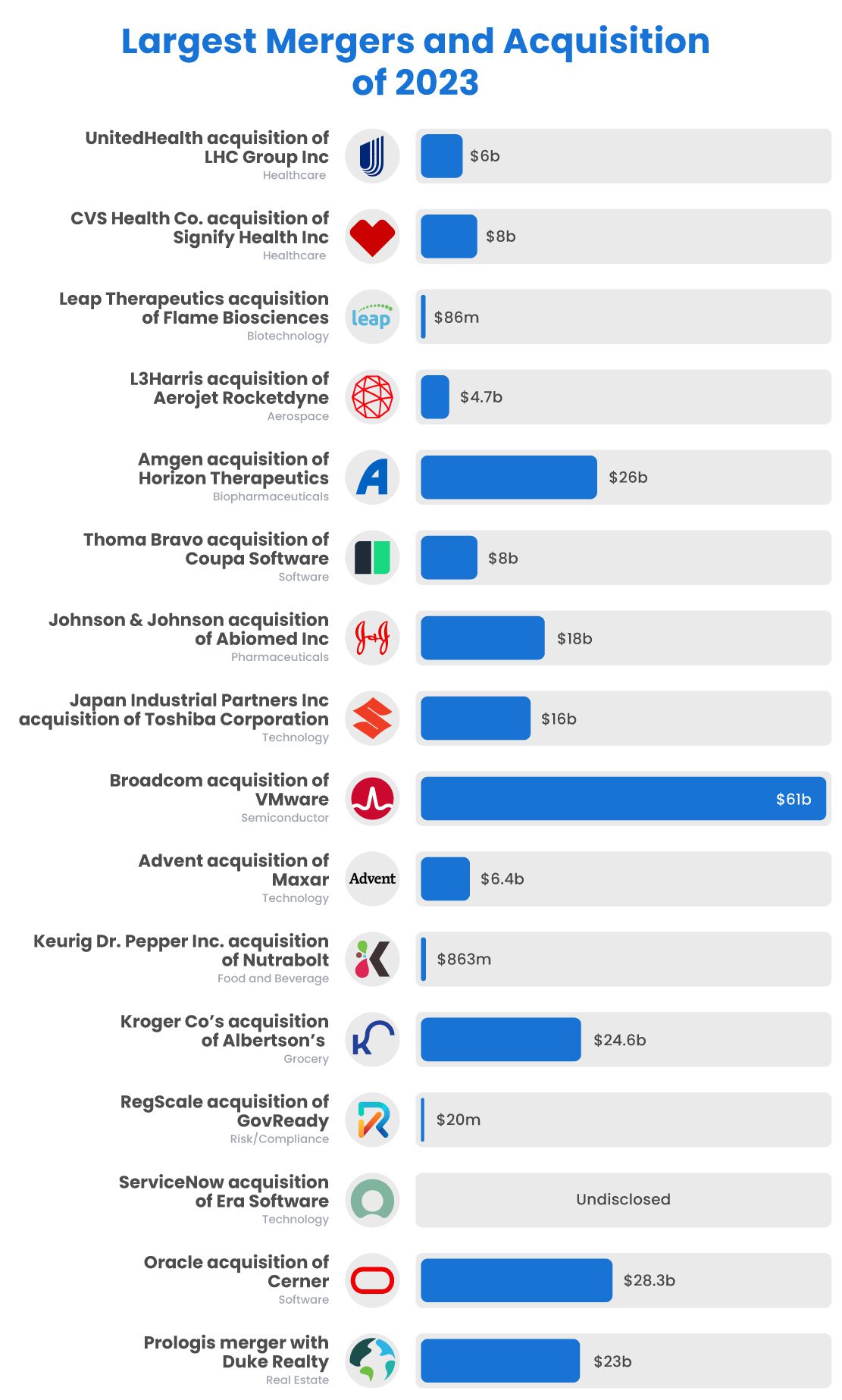

The year 2023 is poised to be a year of divestitures and mergers & acquisitions. However, this was not the case just a few months back. The Divestitures and M&A market witnessed a significant drop in 2022 due to concerns about an impending recession and rising interest rates, discouraging investors from participating in deals. Reports by Refinitiv and the Wall Street Journal revealed that the total value of deals plummeted by 37% compared to 2021’s record high, resulting in a total value of $3.61 trillion. This drop marked the most significant decline since 2001 when global deal values fell by 50% to $1.68 trillion.

However, as we stepped into 2023, businesses began adapting to this new reality by restructuring their deals to leverage market volatility and minimize costs as much as possible. It’s a positive sign that companies are proactively taking measures to navigate these challenging times and emerge stronger.

While the macroeconomic impact of these divestitures and M&As is being closely watched, asset managers and decision-makers in these companies face a daunting challenge – how to successfully merge two distinct entities into a single, efficient organization.

This challenge is complex and multifaceted, encompassing a wide range of tasks such as identifying, categorizing, prioritizing, governing, and ensuring compliance with vast amounts of unstructured and personally identifiable data. Unfortunately, the majority of enterprise data is unstructured, constituting up to 90% of the total datasphere, as per Gartner. Failure to discover and secure this critical asset can lead to significant cost, security, and compliance issues for companies. It can also impede their ability to leverage this valuable asset for decision-making, planning, and strategizing. The challenges are further compounded during M&As and divestitures due to the involvement of numerous people, systems, and assets, which can result in limited visibility into the existing and evolving infrastructure during the transition.

The Challenges of Data During Divestitures and M&As

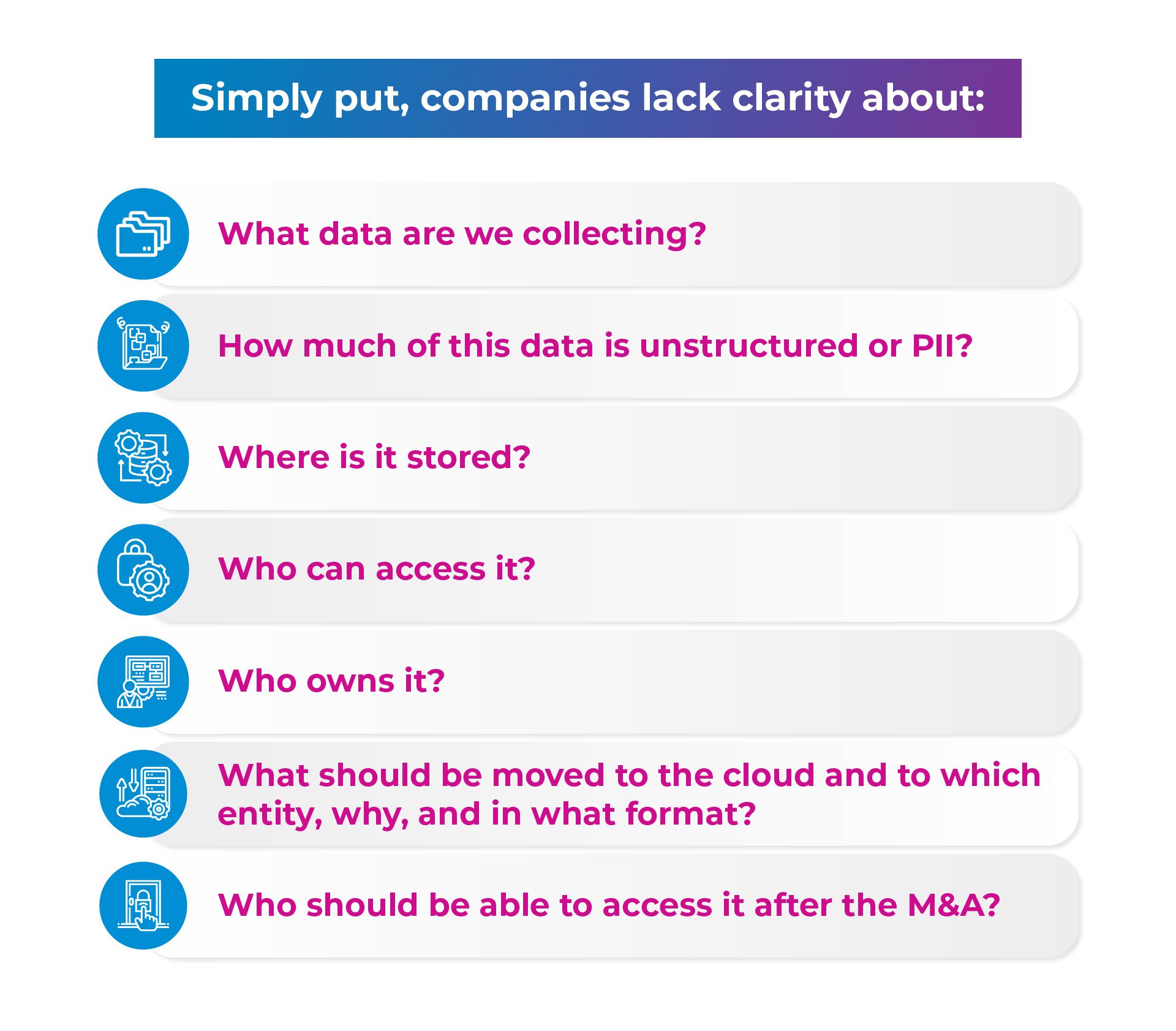

Data is an invaluable asset that must be handled with care, especially during divestitures and M&As. However, identifying, classifying, and optimizing vast amounts of sensitive or unstructured data can be quite challenging.

One of the main hurdles is the fact that data is often commingled and spread out across multiple data centers and IT environments, making it hard to locate. Additionally, it can be difficult to identify data owners and their respective locations.

Another issue arises when determining which data should be migrated to which entity, as organizations may be unsure which data is valuable and relevant. Moreover, the possibility of data loss or damage during divestitures and mergers & acquisitions is incredibly high, leading to legal and regulatory risks.

To make matters worse, archiving or deleting obsolete, incorrect, unnecessary, or duplicate data is a laborious and error-prone task, leading to additional headaches for organizations.

To address these complexities, enterprises often opt for multiple legacy technologies and expand their infrastructure, further complicating matters. It becomes increasingly challenging to identify the data that exists, classify it appropriately, optimize its storage, and determine the best way to migrate it from on-prem data centers to a cloud (or hybrid) environment.

On top of this, organizations often have data silos containing different types, volumes, and formats of data. In fact, a recent study revealed that 90% of businesses struggle with data silos and fragmentation. This adds to the complexity of managing data during Divestitures and M&As and can increase costs.

In order to steer clear of these complications, it is vital to tackle these challenges early on and ensure that the correct amount and type of business-critical data is transferred to each entity. This necessitates a thorough understanding of the data ecosystem and a meticulously planned approach to managing data throughout the Divestiture and M&A process. By doing so, organizations can guarantee a seamless transition and preserve the integrity and security of their data.

This is precisely where a unified data management (UDM) can come to the rescue.

Simplifying Divestitures and M&As with Unified Data Management – 4 Strategies to Overcome data-related hurdles and seize opportunities.

1. Understand the intricacies of data

Unified Data Management (UDM) is a crucial process during Divestitures and Mergers & Acquisitions (M&A) where the goal is to integrate data from two or more companies to create a unified view of the data. In such scenarios, metadata and context analysis are essential tools used to understand the other company’s data. Metadata provides essential information about the data, such as its origin, type, format, and meaning, while context analysis provides an understanding of how the data is related to the company’s business processes. With these tools, UDM can establish a common language between the companies and provide a shared understanding of the data.

Context analysis can also help identify relationships between different data sets and their relevance to the divestitures and M&A’s goals. It can help identify data that is redundant, obsolete, or trivial (ROT), which can be eliminated to reduce storage costs and streamline data management. Additionally, it can help identify critical data sets, such as customer or financial data, which require additional security and governance measures.

Metadata and context analysis can also help identify potential data quality issues that can affect the success of the divestiture and M&A. UDM can use metadata to identify data sources that require additional verification and validation, while context analysis can identify discrepancies between the data sets from different companies. By addressing these data quality issues, UDM ensures that the unified data is accurate, reliable, and fit for purpose.

2. Break down data silos

Merging with another company can be both exciting and challenging, especially when it comes to integrating data. Unstructured data sources like emails, social media feeds, and documents can make data integration even more difficult, leading to inconsistencies, quality issues, and governance problems. Fortunately, Unified Data Management (UDM) is here to save the day! UDM uses advanced machine learning and natural language processing (NLP) algorithms to extract the relevant information from these unstructured data sources. It then structures, tags, and organizes the data into a consistent format that can be easily analyzed and understood by both companies.

This helps break down data silos by creating a shared understanding of the data and integrating data from different business units. With a common language and taxonomy, misunderstandings and discrepancies can be avoided and collaboration and information sharing can be fostered, leading to better decisions and outcomes.

3. Analyze and evade data risks

Content analytics is an essential tool used in UDM to identify sensitive and personally identifiable information (PII) data. It can analyze both structured and unstructured data sources, including text-based files, emails, and social media. By using natural language processing (NLP) algorithms, content analytics can identify and tag sensitive information, such as names, addresses, social security numbers, and other PII and reduce the risk of data breaches, privacy violations, and regulatory compliance issues. Once identified, UDM can develop appropriate measures to protect and secure this sensitive data, including applying advanced security protocols, like data quarantining, access controls, encryption, audit logs or redaction, to safeguard the data. Ultimately, unified data management helps improve the accuracy, accessibility, and reliability of the data, enabling informed decision-making, fostering collaboration, and ultimately driving business success through a secure and trustworthy data environment.

4. Simplify data integration

One of the most critical steps during a divestiture/M&A is to integrate the data sets of both companies to maximize each party’s potential. One way to simplify data integration is by leveraging an Universal Data Engine (UDE). The UDE can handle large volumes of structured and unstructured data from diverse sources and process it in real-time or near real-time. It uses AI, ML, and NLP to perform data integration, cleansing, transformation, and enrichment, making it easier to consolidate data from different companies. This technology also applies advanced analytics and data visualization techniques to make sense of the data and provide actionable insights.

UDEs can handle the complexities of integrating data from different sources, reducing the time and effort required for the integration process. It can also identify duplicate and redundant data, which can be eliminated to reduce storage costs and streamline data management. With the UDE, unified data management can provide a consistent and unified view of the data, ensuring that both companies involved in the divestiture/M&A can access and utilize the data effectively. Furthermore, the UDE can help identify sensitive data, such as personally identifiable information (PII), during the integration process. This information can be flagged and secured to avoid data breaches and ensure compliance with data privacy regulations.

How can Data Dynamics empower enterprises with intelligent data lifecycle management during Divestitures and M&As?

The Data Dynamics platform is a game-changer for organizations looking to unlock the full potential of their data, particularly during divestitures and mergers & acquisitions where utilizing data can be a major challenge. Its Unified Data Management Platform, which consists of four modules – Data Analytics, Mobility, Security, and Compliance – is an award-winning solution that can scale to meet the demands of enterprise workloads for any company looking to acquire, merge or divest businesses. Instead of relying on multiple disparate systems, a single platform can be used to integrate, manage, and analyze data from various sources. The Platform, which is trusted by 25 Fortune 100 companies, leverages automation, AI, ML, and blockchain technologies to streamline data discovery, cleansing, transformation, and enrichment, resulting in actionable insights. With this platform, organizations can make informed decisions, mitigate risks, and maximize the value of their data, even during the complexity of divestitures and mergers & acquisitions.

Visit www.datadynamicsinc.com to know how unified data management can transform your organization’s data ecosystem during and after a divestiture or M&A. You can also contact us at solutions@datadyn.com I (713)-491-4298