- Artificial Intelligence is reshaping the finance industry by ushering in personalized services and transforming traditional approaches. This shift goes beyond being just a technological trend; it’s a fundamental change in financial operations.

- In the coming year, AI is set to introduce five groundbreaking changes in finance. Algorithmic Trading 2.0, enhanced Financial Forecasting, streamlined Compliance Automation, Conversational Banking, and AI-driven Personalized Financial Education will collectively redefine the financial landscape.

- Amidst this transformative era, Unified data management is the real catalyst for AI’s potential. The ability to handle clean, organized data strategically becomes the linchpin, propelling AI beyond a mere technological upgrade to a true enabler of innovation and efficiency in finance.

The financial world is on the brink of a remarkable transformation, all thanks to the powerhouse that is artificial intelligence(AI). It is no more just a trendy buzzword; it’s about to redefine the very essence of finance, infusing it with intelligence and a personalized touch. As we step into 2024, AI is positioned to be the linchpin in reshaping how finance operates, taking a substantial leap forward.

Imagine a world where AI can prevent fraud attempts before they even unfold. Picture intelligent algorithms smoothly navigating the complexities of risk management and fine-tuning investment strategies with precision-driven by data, a concept that was once unimaginable. Think about a customer service experience that is not only fast but also tailored and empathetic, all thanks to AI’s ability to understand individual needs. Now, let’s expand our perspective to a financial landscape where inclusivity is not just an ideal but a reality. AI emerges as the bridge, closing gaps and ensuring that finance is accessible to everyone, regardless of their background. It’s a journey into a future where AI doesn’t just adapt to the financial landscape; it shapes it for the better.

As we delve into the transformative potential of AI in finance for 2024, let’s remember that it’s not just about embracing a technological trend; it’s about entering a future where finance becomes smarter, more responsive, and genuinely inclusive.

5 Innovative Ways AI is Going to Change the Finance Industry in 2024

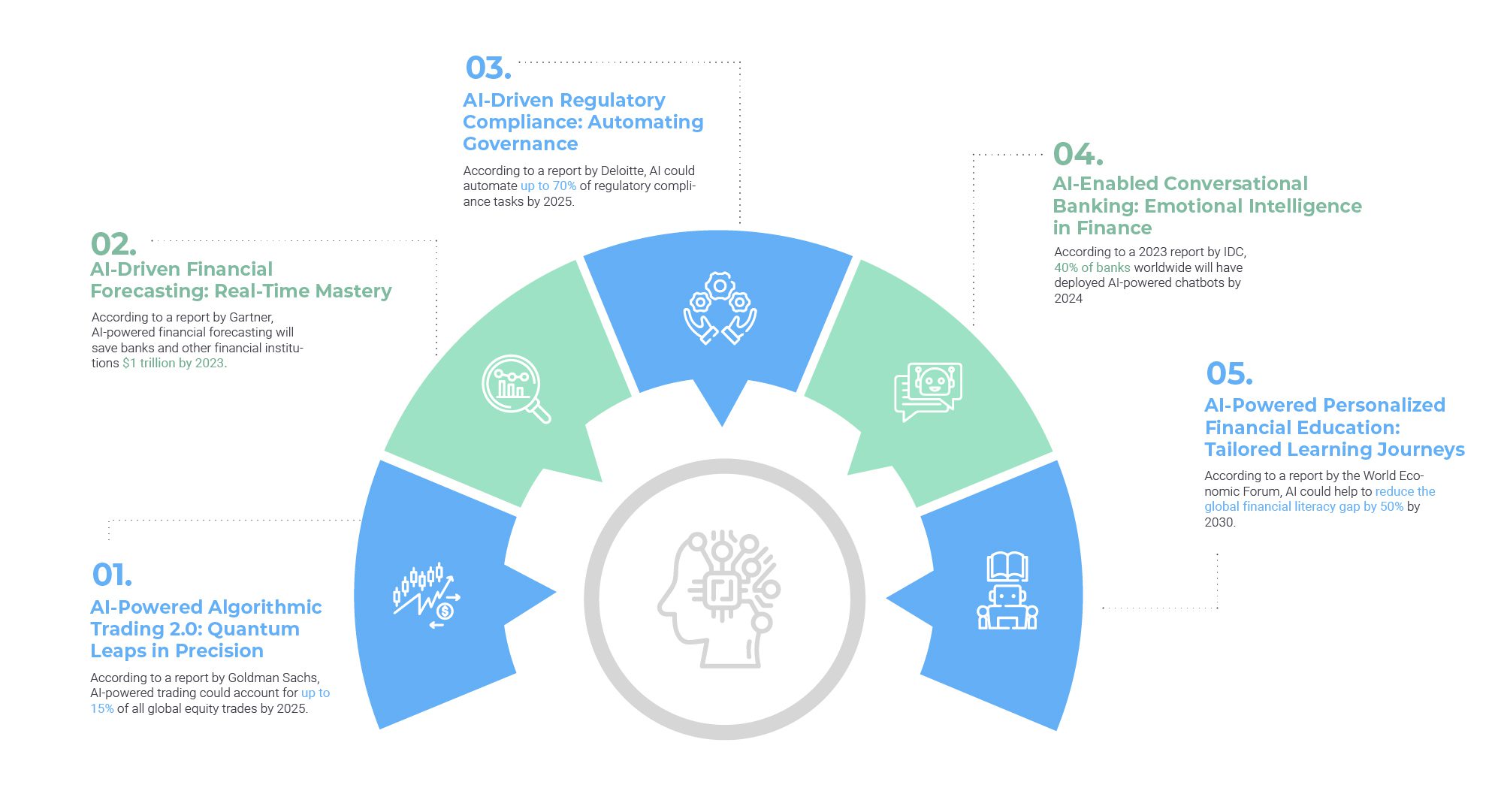

- AI-Powered Algorithmic Trading 2.0: Quantum Leaps in Precision

Algorithmic Trading 2.0 is not just about speed; it signifies a paradigm shift where quantum computing meets market intuition. Quantum machine learning algorithms, with their capacity for parallel processing and adaptive learning, redefine algorithmic trading. It leverages the principles of quantum computing to analyze vast datasets at a speed unattainable by classical computers and enables algorithms to explore multiple possibilities simultaneously, providing a significant advantage in complex financial scenarios. They can comprehend complex market dynamics, factor in quantum probabilities, and execute trades with an unprecedented level of precision. Banks gain a distinct competitive advantage, minimizing risks and maximizing returns in real-time, while consumers experience a more responsive and efficient financial market. According to a report by Goldman Sachs, AI-powered trading could account for up to 15% of all global equity trades by 2025. This is up from just 1% in 2014. AI-powered trading is already having a significant impact on the financial industry. For example, one of the most successful hedge funds in the world uses AI-powered trading algorithms to generate an average annual return of 70%.

- AI-Driven Financial Forecasting: Real-Time Mastery

Real-time financial forecasting in 2024 is empowered by neural networks and sophisticated AI algorithms. Neural networks mimic the human brain’s interconnected structure, enabling AI models to recognize intricate patterns and correlations in vast datasets. This architecture enhances the accuracy and adaptability of financial forecasting models. By incorporating diverse data streams – from global economic indicators to geopolitical events and social media sentiment – these models provide an unprecedented understanding of market dynamics. The benefits extend beyond banks making informed investment decisions; consumers gain access to predictive insights, allowing them to navigate economic shifts with greater confidence. According to a report by Gartner, AI-powered financial forecasting will save banks and other financial institutions $1 trillion by 2023.

- AI-Driven Regulatory Compliance: Automating Governance

AI’s role in regulatory compliance transcends rule-based automation, introducing semantic understanding and contextual awareness. Natural Language Processing (NLP) algorithms in conjunction with machine learning, enable AI systems to understand the nuances of human language and continuously adapt to evolving regulatory frameworks. This synergy not only ensures precision and adaptability in compliance processes but also anticipates potential regulatory challenges. For banks, this translates into streamlined operations, reduced compliance-related risks, and enhanced agility. Consumers benefit from a secure and transparent financial ecosystem. According to a report by Deloitte, AI could automate up to 70% of regulatory compliance tasks by 2025.

- AI-Enabled Conversational Banking: Emotional Intelligence in Finance

Conversational banking in 2024 goes beyond scripted responses; it embraces AI-driven companions with emotional intelligence. Natural Language Understanding (NLU) and sentiment analysis algorithms empower AI to comprehend not just words but also the emotional context behind customer queries. Sentiment analysis algorithms decipher the emotional tone in written or spoken language, while NLU enables AI to understand context, idioms, and colloquial expressions. This dual capability enhances the emotional intelligence of conversational AI. This results in empathetic and personalized interactions, where AI understands and responds to the unique needs of each customer. Banks benefit from improved customer engagement and loyalty, while consumers experience a more human-like connection with their financial institutions. According to a 2023 report by IDC, 40% of banks worldwide will have deployed AI-powered chatbots by 2024.

- AI-Powered Personalized Financial Education: Tailored Learning Journeys

AI’s foray into financial education marks a departure from generic content; it’s about individually tailored learning experiences. Machine learning algorithms analyze user behaviors, financial habits, and learning preferences to curate personalized educational content. Adaptive learning algorithms utilize continuous feedback and data analysis to tailor educational content based on individual progress and preferences. This ensures a personalized and effective learning experience. Banks leverage this to enhance financial literacy among their customers, fostering a more informed and empowered user base. For consumers, it means a bespoke learning journey that empowers them to make informed financial decisions tailored to their unique circumstances. According to a report by the World Economic Forum, AI could help to reduce the global financial literacy gap by 50% by 2030.

Unlocking AI-Driven Transformation in Finance: The Role of Unified Data Management (UDM)

In the dynamic landscape of 2024, where AI is poised to revolutionize the finance industry, the linchpin enabling this transformative journey is Unified Data Management (UDM). It emerges as the bedrock, the invisible force streamlining the colossal volumes of data essential for AI’s sophisticated algorithms to thrive. It’s not just about managing data; it’s about orchestrating an environment where data becomes a strategic asset, fueling AI-driven insights and innovations.

- Data Visualization: Crafting Insightful Narratives

In the era of AI, data becomes the canvas on which financial insights are painted. UDM, with its focus on Data Visualization, enables financial institutions to go beyond raw numbers. By employing advanced visualization tools, institutions can transform complex datasets into insightful narratives. This not only facilitates better decision-making but also enhances communication, ensuring that AI-driven insights are accessible and comprehensible across diverse stakeholders.

- Data Intelligence: Powering Informed Decision-Making

UDM’s commitment to Data Intelligence ensures that AI algorithms are fed with high-quality, accurate data. Financial institutions leveraging UDM can integrate AI seamlessly into their operations, empowering intelligent decision-making. Through continuous analysis and learning, AI systems refine their intelligence over time, ensuring that financial professionals are equipped with the most relevant and precise information to navigate the dynamic landscape.

- Data Optimization: Maximizing AI Efficiency

In the AI-driven financial ecosystem, the efficiency of algorithms is paramount. UDM’s Data Optimization pillar ensures that data is not just abundant but relevant and well-organized. By streamlining data storage, retrieval, and processing, UDM facilitates AI algorithms to operate at peak efficiency. This optimization leads to faster processing times, reduced latency, and overall improved performance, translating into enhanced customer experiences and operational excellence.

- Data Minimization: Precision in Data Handling

Precision is the essence of AI, and Data Minimization aligns seamlessly with this principle. By ensuring that only essential data is collected and retained, UDM minimizes the risk of information overload and ensures that AI algorithms focus on the most pertinent variables. This precision not only enhances the accuracy of AI predictions but also aligns with evolving data privacy regulations, fostering trust among consumers.

- Data Security: Fortifying the Digital Fortress

In the AI-driven financial landscape, data is not just an asset; it’s a liability if not secured adequately. UDM’s Data Security pillar is the sentry, safeguarding sensitive financial information from cyber threats. Through robust encryption, access controls, and proactive threat detection, UDM ensures that AI systems operate within a secure environment. This not only protects the financial institution from potential breaches but also builds trust with customers who entrust their data to these systems.

- Data Governance: Orchestrating Data Harmony

Harmony in the AI symphony is achieved through UDM’s Data Governance pillar. It establishes the rules, policies, and procedures that dictate how data is managed across the organization. With a standardized governance framework, financial institutions ensure consistency and coherence in their AI initiatives. UDM’s governance ensures that AI algorithms adhere to ethical standards, legal requirements, and industry best practices, fostering responsible and sustainable AI development.

- Data Compliance: Navigating Regulatory Landscapes

As financial institutions navigate intricate regulatory landscapes, UDM’s Data Compliance pillar becomes their guiding compass. UDM ensures that AI initiatives align with data protection laws, industry regulations, and evolving compliance standards. By embedding compliance considerations into the fabric of AI systems, UDM enables financial institutions to innovate with confidence, knowing that their AI-driven transformations adhere to the highest regulatory standards.

The Data Dynamics Advantage

Handling vast amounts of unorganized data for AI-driven opportunities in the finance sector poses a major challenge. Financial institutions gather heaps of data from various sources and 80% of it is unstructured. Choosing the right way to manage this data—whether building an in-house team or partnering with an external vendor—has significant impacts on how efficiently operations run and how profitable the institution is. Tackling unstructured data might seem overwhelming, but mastering this aspect puts financial organizations ahead of competitors struggling with messy and inefficient data systems. This is where Data Dynamics stands out.

Data Dynamics is a top-notch provider of enterprise data management solutions, particularly in handling unstructured data complexities through its Unified Unstructured Data Management Platform. This comprehensive platform covers four crucial modules: Data Analytics, Mobility, Security, and Compliance. Trusted by over 28 Fortune 100 organizations, the Data Dynamics Platform combines automation, AI, ML, and blockchain technologies. It seamlessly adapts to meet global enterprise workloads. By partnering with Data Dynamics, financial institutions move away from scattered solutions and conflicting data views. Instead, they embrace a unified software platform that not only brings order to unstructured data but also unlocks valuable insights, enhances data security, ensures compliance and governance, and drives cloud data management initiatives.

Data Dynamics aims for a future where financial institutions achieve data democratization. This means users of different technical backgrounds can quickly access, understand, and extract maximum insights from sprawling, unstructured data landscapes.

To explore how Data Dynamics can help your enterprise organize unstructured data and save costs, check out our offerings at www.datadynamicsinc.com or contact us at solutions@datdyn.com or (713)-491-4298.