A brand is not a logo but the meaning associated with it!

In a Deloitte study, 88% of executives believe brand reputation poses the biggest threat to their business. Brands that offer value and are meaningful outperform other brands in the stock market by more than 100%.

Ever wondered what the secret is behind the world’s most successful brands?

The Story of the Apple

Apple is one of the most successful brands in terms of brand reputation and revenue. According to Statista, Apple’s brand value is 352 billion dollars, with revenues growing to 260 billion in 2019 from 8 billion in 2004. Steve Jobs once said, “You’ve got to start with Customer Experience and work back toward the technology, not the other way around.”

Apple’s secret is all about providing an exceptional customer experience! The company measures success not by how much money they make but by how loyal and trusting its customers are. Apple has topped the list of branding behemoths published by Forbes consecutively for over a decade. And it remains the most valuable brand in the world, with a record valuation of more than $355 billion, according to the latest Brand Finance Global 500.

How can financial institutions and banks establish similar brand value with their customers? What should they do to provide an exceptional customer experience?

Decoding Customer Experience in Banking and Finance

As the number of financial institutions worldwide grows, competition is becoming fierce, making customer satisfaction a crucial factor in driving business. Many years ago, banks providing extended bank hours and phone support were considered customer friendly. Today, banks offering digital banking solutions are considered customer friendly.

The definition of customer experience has evolved a great deal in the banking and finance sector. As a matter of fact, during COVID-19, banks offering digital solutions were making the lives of their customers easy as opposed to traditional banks. And nowadays, finance companies and banks providing user-friendly mobile apps and 24X7 customer support are in a real sense providing value to their customers. According to the PWC report, 65% of U.S. customers believe a positive experience is more important than advertising. As per Forrester’s report 2020, 73% of multichannel banking customers said they had a positive experience with customer service at their bank.

This brings us to the question – What drives superior customer experience in finance and banking?

A Meaningful Customer Experience Requires Meaningful Data

Data plays an important role in today’s rapidly evolving customer experience landscape!

With a personalized experience and a deeper relationship with their customers, financial institutions can create a meaningful brand experience. The only way to do this is to develop a better understanding of the customer. As a result of an ever-evolving digital ecosystem, multiple touchpoints complicate the process of understanding customers. Data gives organizations a 360-degree view of customers, allowing them to gain valuable insight into their buying journeys and better understand customer needs and patterns.

Five data-driven approaches for an effective customer experience strategy:

- Understand your data and classify it according to your customers. Identify redundant, obsolete, and trivial data to make data-driven choices.

- Create customer profiles depending on the data identified. Map your relationship/history with the profiles created.

- Analyze your data and create customer journeys that will provide deeper insight into customer purchasing patterns.

- Segment the analyzed data per the customer details to create a group of similar customer journeys and preferences.

- Put your data to use to improve customer experience with personalized customer offers.

The right data at the right place and in the right form can give you an insider’s view of your customer’s persona and needs. And further, it can help build a 360-degree customer experience that is positive, effective, and compelling. With this single step, customers can feel more appreciated and understood, increasing the brand value and generating more revenue.

Cloud for 360-degree Customer Experience

All data needs a digital platform to carry the right information to the customers. The Cloud plays a major role in unifying data and presenting it to customers in the form of mobile app information, website information, etc. Let’s understand further the role of the Cloud in this game.

- Interactive Chatbots: Cloud-based chatbots used by customers and potential customers source many insights into customer requirements.

- Smart Customer Support: AI and ML-based real-time troubleshooting tools are hosted on the Cloud and generate a major chunk of data.

- Data Analytics: As we have discussed earlier, Cloud plays an essential role for organizations seeking to provide a customized experience to their customers through data analytics.

This is just the tip of the iceberg. Learn more about how the Finance and Banking Industry utilizes cloud computing in this blog – Cloud Computing: No More a Costly Affair for Financial Services Organizations.

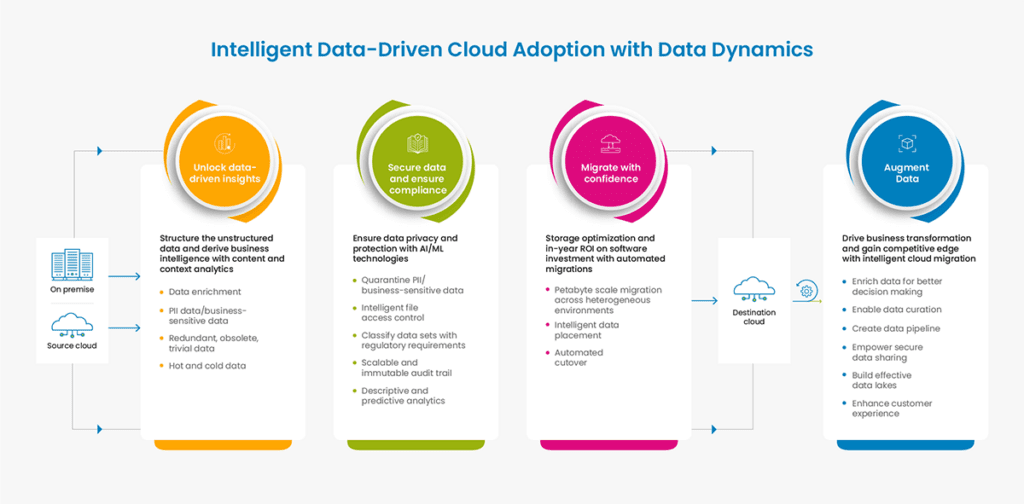

Importance of Data-driven Cloud Migration

Cloud migration is a fast-growing trend today, yet organizations lack a clear migration strategy. The most efficient way to migrate data to the cloud is to use a data-driven approach as opposed to the traditional lift and shift approach. The migration is intelligent, secure, and cost-effective. In a nutshell, enterprises will understand their data and make decisions based on insights from existing data. It’s one of the most effective and efficient ways to secure data, accelerate timelines and reduce costs during a migration.

Data Dynamics, a leading provider of enterprise data management solutions via its Unified Unstructured Data Management Platform, recently hosted a webinar in which expert speakers stressed upon the importance of data-driven cloud migration. Here’s a webinar summary: Reimagine, Reorganize, and Reinforce Cloud Migration with a Data-Driven Approach.

Click here to check out how Data Dynamics utilized the Azure File Migration Program to help one of the world’s seven multinational energy “supermajors” Fortune 50 companies accelerate its net zero emission goals while driving digital transformation.

The unified approach Data Dynamics uses to study data, categorize it, find sensitive data, and archive it along with access control, data quarantining, and immutable audit trails ensure quick, efficient, and effective cloud adoption. As a part of our ‘accelerating cloud adoption’ objective, we have recently collaborated with Microsoft Azure to help enterprises migrate data into Azure at zero cost. Now organizations can move their unstructured files and object storage data into Azure without paying a cent or purchasing separate migration licenses. Migrations are automated and ensure minimal risk with automatic access control and file security management.

Click here to know more about the program.

Visit – www.datadynamicsinc.com. Contact us solutions@datdyn.com or click here to book a meeting.