Picture this: you’re navigating through stormy economic waters, trying to keep your financial ship afloat amidst the turbulence of a recession. Every decision you make is crucial, and the last thing you need is a costly investment that could sink your chances of survival. It’s a daunting scenario, isn’t it? Well, fear not, my fellow navigators of the business world, because there’s a transformative solution that could be your compass in these troubled times: the cloud.

Now, hold on just a moment! Before you dismiss this as another generic statement or dismiss cloud computing as an expensive luxury, let’s embark on a journey together and uncover the hidden treasures that the cloud holds for the BFSI industry during a recession.

In times of financial uncertainty, one might assume that slashing costs left and right is the only way to weather the storm. And while tightening the purse strings is indeed essential, abandoning the cloud is not the answer. The truth is the cloud has evolved far beyond its reputation of being a hefty expenditure. It has become a lifeline for businesses, enabling them to combat the recession head-on while staying profitable and resilient.

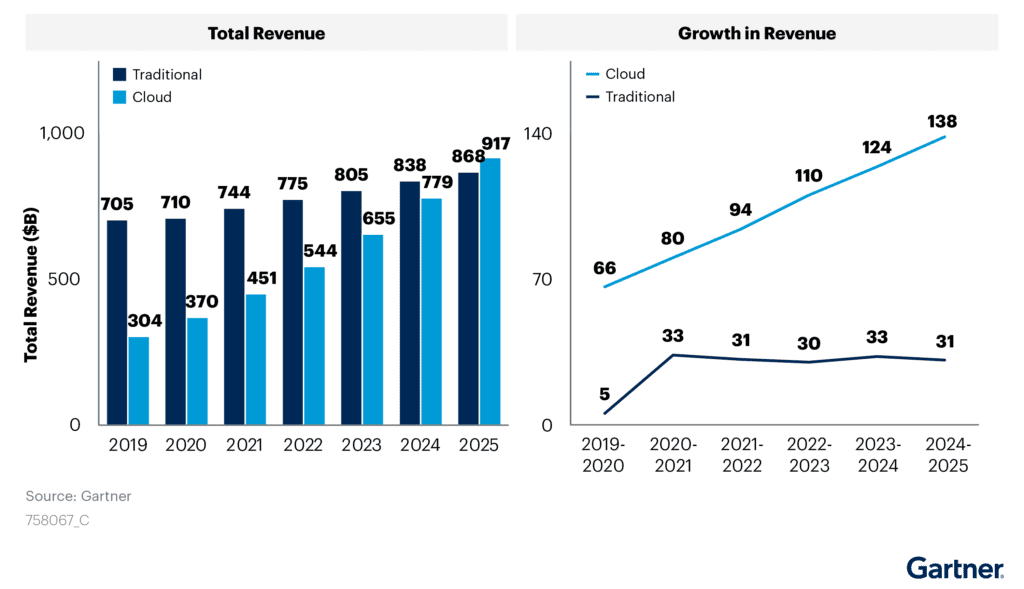

Figure 1: Sizing Cloud Shift, Worldwide, 2019 – 2025

So, what exactly makes the cloud the go-to solution for the BFSI industry during these challenging times? Let’s delve into FIVE reasons that make the cloud a game-changer in the face of economic uncertainty.

Unlocking the 5 key reasons BFSI industry turns to cloud during recession

- Cost optimization and agility: doing more with less

When confronted with an economic downturn, banks are under immense pressure to optimize costs and streamline their operations. Traditional on-premises infrastructure can be a significant drain on financial resources, requiring substantial investments in hardware, maintenance, and security. However, the cloud presents an alternative that allows banks to shift from a capital expenditure (CapEx) model to an operational expenditure (OpEx) model. By leveraging cloud infrastructure, banks can significantly reduce their upfront costs, paying only for the resources they consume. This enables them to scale their infrastructure up or down rapidly, aligning with fluctuations in customer demand and market conditions.

According to a report by Flexera, 94% of enterprises surveyed have seen cost savings in the cloud, with 77% experiencing further cost optimization within the first year. For banks, this translates into substantial savings that can be redirected towards core business initiatives, such as customer experience enhancements or digital innovation.

Take JPMorgan Chase, one of the world’s largest banks, as an example. They realized the potential of cloud technology and made a strategic move to transition to the public cloud. By doing so, they aim to reduce their infrastructure costs by a staggering $200 million every year. This cost optimization strategy allows them to allocate resources more efficiently, freeing up capital for other critical areas. - Enhanced security and compliance: protecting what matters most

The banking sector operates under stringent regulatory frameworks to safeguard customer data and maintain privacy. Migrating to the cloud might raise concerns about security and compliance, but cloud service providers invest heavily in robust security measures to address these apprehensions. In fact, many banks find that cloud infrastructure can offer more comprehensive security than their on-premises systems.

Major cloud providers, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, are compliant with industry standards and certifications, including ISO 27001 and SOC 2. They employ sophisticated encryption protocols, automated backups, and disaster recovery mechanisms to ensure data protection and availability. By leveraging the expertise of cloud providers, banks can offload the responsibility of security management and focus on their core competencies.

Capital One, a leading American bank, serves as a notable example. They adopted a cloud-first strategy to enhance their security posture. By leveraging cloud technologies, Capital One has fortified their security controls, implemented real-time threat detection, and improved incident response capabilities. This proactive approach not only protects their customers’ data but also positions them as a trusted financial institution during uncertain times. - Scalable data analytics and ai: unleashing the power of insights

Data analytics and artificial intelligence (AI) play a pivotal role in making informed decisions within the banking industry. The cloud offers powerful computational capabilities and storage capacity to efficiently process vast amounts of data. Banks can leverage this capability to gain actionable insights, enhance risk management practices, personalize customer experiences, and identify emerging trends.

The ability to scale resources on-demand is a game-changer. Cloud-based data analytics solutions enable banks to process complex models and algorithms swiftly. This scalability empowers them to stay ahead of the competition and adapt to changing market conditions, even during recessions.

Consider Banco Bradesco, a leading Brazilian bank. They leveraged cloud-based AI and data analytics to transform their fraud detection capabilities. By analyzing large volumes of data in real-time, Banco Bradesco achieved a 70% reduction in fraud-related losses and significantly enhanced customer trust. Cloud-enabled data analytics and AI give banks the competitive edge needed to thrive in a challenging economic environment. - Innovation and collaboration: building a future-ready banking experience

The cloud fosters a culture of innovation and collaboration within banks. By embracing cloud-native technologies and utilizing platform-as-a-service (PaaS) offerings, banks can rapidly develop and deploy new digital services that cater to the evolving needs of their customers. Cloud-enabled collaboration tools facilitate seamless teamwork among dispersed teams, enhancing productivity and fostering innovation. This collaborative environment allows banks to experiment with new ideas, iterate quickly, and bring innovative solutions to market faster.

Furthermore, the cloud opens avenues for banks to leverage emerging technologies like blockchain, Internet of Things (IoT), and machine learning. These technologies, when integrated with cloud platforms, create transformative solutions that drive operational efficiency and enhance customer experiences. This combination of innovation, collaboration, and cutting-edge technologies positions banks as industry leaders and disruptors.

DBS Bank, based in Singapore, serves as a prime example of a bank that has embraced the cloud to fuel its digital transformation journey. By adopting a cloud-first approach, DBS Bank has streamlined internal processes, accelerated product innovation, and launched customer-centric digital services. Their agile and innovative approach resulted in record-breaking profits during the recession, proving the power of the cloud in driving success. - Business continuity and disaster recovery: ensuring uninterrupted operations

In times of recession, ensuring business continuity and disaster recovery becomes paramount for banks. Traditional on-premises systems are susceptible to disruptions caused by natural disasters, hardware failures, or power outages. However, the cloud provides built-in redundancy and robust disaster recovery mechanisms.

By leveraging the cloud, banks can replicate their data and applications across multiple geographic regions, ensuring redundancy and minimizing the risk of downtime. In the event of a disaster or system failure, the cloud enables quick failover and recovery, allowing banks to resume operations seamlessly and minimize the impact on their customers. Moreover, the cloud offers high availability and uptime guarantees, backed by Service Level Agreements (SLAs). This ensures that critical banking services remain accessible to customers, even during challenging times. By relying on cloud infrastructure for business continuity and disaster recovery, banks can safeguard their operations and maintain customer trust in the face of disruptions.

For instance, a leading international bank like Citigroup has embraced the cloud for its disaster recovery strategy. They leverage cloud-based solutions to replicate critical systems and data in real-time, enabling rapid recovery and ensuring uninterrupted operations in the event of a disruption.

As mentioned previously, in times of adversity, it’s common for businesses to tighten their belts and scale back on transformation projects, with the cloud often being the first casualty. However, this short-sighted approach fails to recognize the true value of the cloud. It’s high time we debunk the myth that the cloud is an extravagant expense. Instead, enterprises must wholeheartedly embrace the cloud as a formidable tool that empowers banks to not only maintain profitability but also foster growth and navigate economic uncertainties with unwavering resilience and agility. The cloud revolution has been underway for quite some time now, steadily gaining momentum, and leading the charge is none other than Azure. Let’s delve into the reasons why Azure stands at the forefront of this transformative wave.

Why banks choose microsoft azure as their premier cloud provider

In the realm of cloud computing, Microsoft Azure has emerged as the top choice for banks seeking to harness the transformative power of the cloud. Azure’s impressive array of technologies, unmatched security measures, and industry-leading compliance certifications make it the comprehensive cloud platform of choice for driving innovation, enhancing operational efficiency, and delivering exceptional customer experiences in the banking industry. In this article, we’ll explore why Microsoft Azure has risen to prominence, supported by compelling statistics, insightful quotes, and real-world examples.

- Cost-effectiveness and flexible pricing models

Cost optimization is a critical consideration for banks, especially during times of economic uncertainty. Microsoft Azure offers cost-effective solutions and flexible pricing models that empower banks to optimize their cloud investments.

Azure’s pay-as-you-go pricing model allows banks to pay solely for the resources they utilize, eliminating the need for significant upfront infrastructure investments. This flexibility enables banks to scale their cloud usage up or down based on business demands, aligning costs with actual usage and avoiding unnecessary expenses. Additionally, Azure provides cost management and optimization tools such as Azure Cost Management + Billing, which offer visibility into cloud spending and identify cost-saving opportunities. With these tools, banks can effectively track usage, set budgets, and implement cost-control measures.

By leveraging Azure’s cloud services and cost optimization tools, banks can achieve substantial cost savings. According to LogicMonitor, organizations that migrate to the cloud can reduce infrastructure costs by an average of 15% to 50%.

- Unmatched security and compliance

Security and compliance are of utmost importance in the banking industry. Microsoft Azure sets the standard by offering advanced security features and strict adherence to regulatory requirements. With robust data encryption, threat detection capabilities, and access control mechanisms, Azure provides a secure environment for banks to store, process, and transmit sensitive financial data.

Azure’s commitment to security is evident in its substantial investments. Microsoft allocates over $1 billion annually to security research and development for Azure. Furthermore, Azure boasts a comprehensive compliance portfolio with over 90 global certifications, ensuring that banks effortlessly meet regulatory obligations.

- Advanced data analytics and ai capabilities

Data analytics and AI are pivotal in the banking industry’s digital transformation journey. Microsoft Azure offers a comprehensive suite of services to unlock the power of data-driven insights and AI algorithms. Azure’s data analytics services, such as Azure Synapse Analytics and Azure Data Lake, enable banks to process vast amounts of data and derive actionable insights for informed decision-making.

Moreover, Azure provides an extensive range of AI tools and frameworks, including Azure Machine Learning and Azure Cognitive Services. These empower banks to build intelligent applications, automate processes, and deliver personalized customer experiences. Azure’s scalability ensures the efficient processing of complex models and algorithms, giving banks a competitive edge.

- Seamless integration and hybrid capabilities

Banks often have complex IT environments comprising a mix of on-premises systems and cloud infrastructure. Microsoft Azure excels in providing seamless integration and hybrid capabilities, allowing banks to leverage existing investments while embracing the benefits of the cloud.

Azure’s hybrid capabilities enable banks to establish secure connections between on-premises infrastructure and the cloud, facilitating a smooth transition and integration of legacy systems. This flexibility allows banks to adopt a phased approach to cloud adoption, mitigating risks and ensuring business continuity.

Notably, Azure Arc enables banks to extend Azure services to any infrastructure, whether it’s on-premises, at the edge, or in other cloud environments. This flexibility empowers banks to leverage Azure’s comprehensive suite of services wherever their data resides, creating a unified and efficient operational environment.

- Extensive partner ecosystem and industry expertise

Microsoft Azure’s extensive partner ecosystem and industry expertise make it an attractive choice for banks. Azure’s ecosystem comprises a wide range of third-party solutions, enabling banks to leverage specialized tools and technologies tailored to their specific needs. This ecosystem empowers banks to accelerate innovation, streamline processes, and deliver unique value to customers.

Furthermore, Azure offers industry-specific solutions like Azure for Banking and Azure for Financial Services, demonstrating Microsoft’s deep understanding of the banking sector’s unique challenges and requirements. These solutions provide banks with pre-built templates, compliance frameworks, and regulatory insights, easing the path to cloud adoption and ensuring regulatory compliance.

The Data Dynamics advantage

While the world of cloud computing holds great fascination, data migration is often the initial step in leveraging its benefits. Organizations require a straightforward, precise, and repeatable approach to transferring their data to the cloud. Unfortunately, manual processes and budget constraints can create bottlenecks, impeding the progress of cloud initiatives. Migrating critical applications such as Virtual Desktop, Virtual Server, High-Performance Compute, and Analytics to the cloud involves transferring significant amounts of file data, ranging from tens of terabytes to several petabytes, stored across various platforms like file servers, NAS appliances, and Object Storage. To overcome the inherent complexity and risk of file data migration between these platforms, automated, intuitive, and scalable solutions are essential.

In pursuit of mitigating these challenges, Microsoft has partnered with Data Dynamics to launch the Azure File Migration Program, enabling enterprises to migrate their data to Azure at no cost. This collaboration allows organizations to transfer unstructured files and object storage data to Azure without incurring expenses or requiring additional migration licenses. Our automated migration process reduces risks while maintaining access control and file security to uphold data integrity. Moreover, this partnership empowers intelligent data management across On-Premise, Azure, and Hybrid Cloud environments, enhancing overall efficiency and effectiveness. Customers can register their migration projects with Data Dynamics and commence data movement immediately.

Here are some additional insights into how our platform facilitates intelligent data tiering to Azure:

- Automated data migration: Data Dynamics provides various automated methods to migrate data from on-premises storage to Azure. This includes file-level migration, where individual files, folders, or shares can be migrated, as well as volume-level migration, allowing for the migration of entire volumes from on-premises storage to Azure.

- Policy-based data tiering: With our platform, you can create policies that automatically move data to different storage tiers based on its usage patterns. This helps optimize costs by ensuring that data is stored in the most cost-effective tier according to its level of activity. For example, you can establish a policy to move data that hasn’t been accessed for more than 30 days to the Azure Archive tier.

- Data governance: Implementing data governance policies is crucial for secure and compliant data storage. Our platform enables you to establish policies that enforce data security measures, such as requiring encryption before storing data in Azure. This ensures data protection and helps meet regulatory requirements.

Through the Azure File Migration Program, Microsoft and Data Dynamics aim to assist organizations in addressing critical challenges encountered throughout the cloud migration lifecycle, including cost, speed, talent, and risk.

Data Dynamics offers a robust data management platform that facilitates data movement, management, and cost optimization within Azure. If you’re seeking a solution to achieve these objectives, Data Dynamics is an excellent option to consider. To explore more about Data Dynamics, please visit our website at www.datadynamicsinc.com or contact us at solutions@datdyn.com or call us at (713)-491-4298 or +44-(20)-45520800.