Hold on to your hats, because the digital banking industry is taking the world by storm! From its humble beginnings to its current state, digital banking has revolutionized the way we handle our finances. Thanks to smartphones, mobile banking has taken off, letting us complete transactions with ease, even when we’re on the go. But that’s just the tip of the iceberg. Today’s digital banking boasts a dizzying array of features that we could only dream of before. Biometric authentication, virtual assistants, and AI-powered chatbots that can give personalized financial advice are just a few of the awesome tools at our disposal. And that’s not all – it has given rise to a whole new breed of financial tech startups – Fintechs, that are changing the game with their innovative approaches. With all these incredible advancements, digital banking is at the cutting edge of innovation, and it’s just getting started. In this blog post, we’ll explore how AI and cloud technology are revolutionizing this sector, boosting security, innovation, and profitability. So fasten your seatbelt as we take you on an exciting journey into the future of finance!

Demystifying Digital Banking: Understanding the Future of Finance.

Digital banking, also known as online banking, has revolutionized the way we handle our finances. The concept can be traced back to the early 1980s, when ATMs (automated teller machines) were introduced, allowing customers to withdraw cash without visiting a physical bank branch. However, the real revolution began in the late 1990s with the advent of internet banking. It allowed customers to manage their accounts and perform transactions online, without the need for physical presence at a bank.

Over the years, digital banking has continued to evolve, making banking more convenient and accessible for customers. The introduction of mobile banking in the mid-2000s, further amplified this transformation, enabling customers to 24/7 access their accounts and perform transactions from their smartphones and tablets. Another key factor driving the growth of digital banking is security. Banks have invested heavily in advanced encryption technologies to protect customer data and mitigate fraud and identity theft risks. Additionally, with the increasing popularity of fintech companies, digital banking has become more innovative, introducing features such as budgeting tools, investment options, and real-time account monitoring. Also, some major breakthroughs in recent years, such as the introduction of contactless payments and the implementation of biometric authentication has also fuelled its growth and popularity.

Today, digital banking has become a norm and its future is even more exciting. With constant innovation and breakthroughs, it has become an integral part of our lives, making banking more convenient and accessible than ever before. And as technology continues to evolve, we can expect to see further advancements in areas such as artificial intelligence, cloud, blockchain, and open banking from banks looking to stay ahead of the curve.

Revolutionizing Digital Banking: The Impact of AI on the Financial Industry

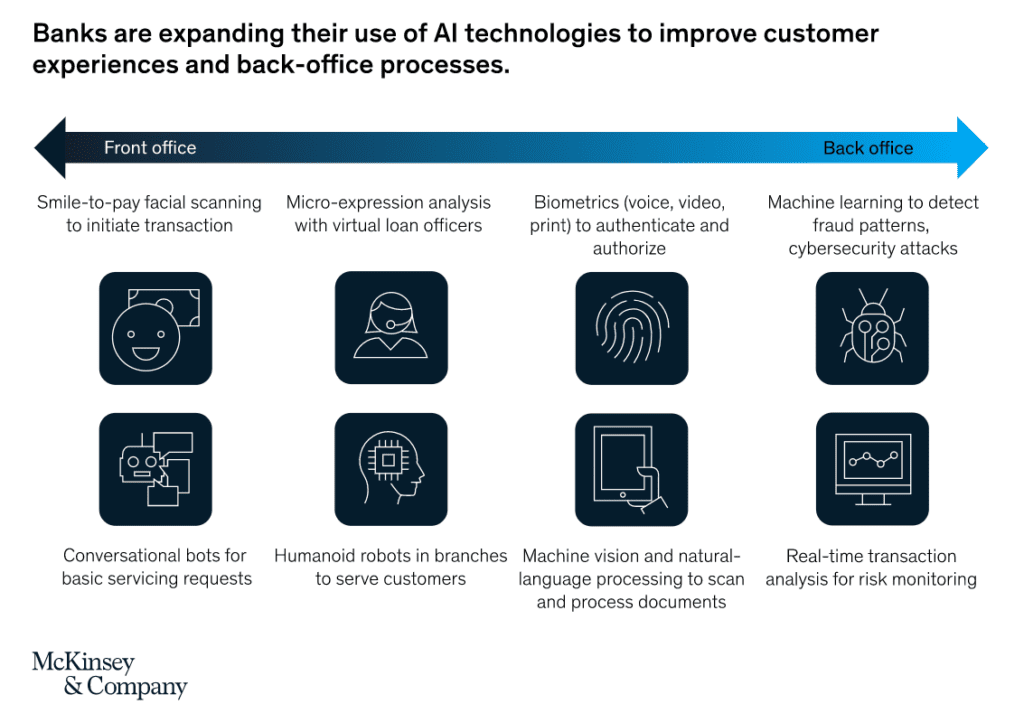

AI has evolved tremendously since its inception in the 1950s. From automating mundane tasks like data entry and calculations, it has now become a game-changer in the banking industry. With the availability of massive amounts of data and technological advancements, conversational AI is rapidly being adopted by banks to provide exceptional customer experiences, streamline operations, and strengthen security measures.

Providing exceptional customer experience: Over the years, AI has made remarkable strides, with Conversational AI being at the forefront of this development. By leveraging natural language processing (NLP), this technology allows customers to communicate with their bank accounts in a conversational manner. It enables machines to understand human language by analyzing text or speech input and carry out tasks such as balance inquiries, money transfers, bill payments, and personalized financial advice based on personal data analysis. With the power of machine learning algorithms, chatbots can continue to learn from past customer interactions, improving their accuracy and responsiveness over time. By leveraging deep learning models, which utilize neural networks like those in our brains to process complex information accurately, conversational AI can provide customers with quick and tailored responses, making banking more convenient and accessible. However, it is essential for banks to ensure that this technology is implemented securely while upholding privacy standards. As conversational AI becomes increasingly prevalent in the digital banking sector, it is crucial for banks to leverage its benefits while mitigating any potential risks associated with these technologies.

Improve operational efficiency: AI is transforming the banking industry, enhancing operational efficiency and cutting down costs. Machine learning, a popular AI technology, is enabling banks to automate their decision-making processes, analyze large data sets to predict outcomes, identify patterns, and detect anomalies. With tailored products and services, banks can now cater to their customers’ specific needs and preferences. Moreover, the application of Natural Language Processing (NLP) technology is allowing banks to analyze and comprehend customer requests, providing personalized responses that enhance their experience. Chatbots, powered by AI, are increasingly becoming popular in banking as they automate routine tasks, reduce wait times, and provide customers with immediate support. Additionally, Robotic Process Automation (RPA) is being employed in various core processes to automate manual and repetitive tasks, freeing up staff to focus on more complex tasks that require human intelligence. Lastly, AI is also being utilized for fraud detection and prevention, analyzing transaction patterns to identify fraudulent activities and reduce losses.

Strengthening data security & compliance: The integration of AI technology in the banking industry to enhance data security and regulatory compliance is a fascinating development. With the implementation of advanced technologies such as machine learning, natural language processing (NLP), predictive analytics, and blockchain, the industry is being revolutionized. Banks can now use machine learning algorithms to detect fraudulent activities by analyzing transaction data patterns, while NLP technology scans unstructured data to identify potential risks and security threats. Predictive analytics enables proactive measures to prevent customers from defaulting on loans or credit payments by analyzing customer data and behavior to predict future trends and potential security threats. Finally, the use of blockchain technology provides an extra layer of security, ensuring transaction integrity and preventing unauthorized access to sensitive information through a decentralized ledger system.

By now, we all agree that AI is at the forefront of banking transformation. Forward-thinking banks have already integrated AI into their operations and are experiencing impressive results. Here are some examples that demonstrate how AI integration enhances efficiency in the banking sector and delivers smarter insights faster than ever before, leading to improved customer satisfaction.

- One example of a company using AI at a mammoth scale in digital banking is JPMorgan Chase. The bank uses machine learning algorithms to analyze massive amounts of data to identify potential fraud cases more accurately. This technology helps them reduce false positives and provides their customers with greater security while using digital services.

- Another notable example is Bank of America, which developed its virtual assistant, Erica, that offers voice-enabled transactions through smartphones or home devices such as Amazon’s Echo. Erica can help users track expenses, pay bills and provide personalized financial advice based on user inputs.

- Wells Fargo also utilizes chatbots powered by natural language processing (NLP) technology to improve customer service by allowing customers to ask questions about account balances, transactions, and other related queries 24/7 without needing assistance from human agents.

Transforming the Future of Banking: The Role of Azure in Accelerating AI Adoption

The financial services industry is undergoing a thrilling transformation with the aid of AI and machine learning algorithms. However, their implementation requires substantial computing power and storage, making on-premise solutions cost-prohibitive. Luckily, cloud computing has emerged as a game-changer. With virtually unlimited compute power and storage, banks can store and process vast amounts of data quickly and efficiently. The scalability of cloud-based infrastructure means that as a bank’s AI needs grow, so can their cloud resources. And the best part? Cloud solutions are cost-effective, providing a pay-as-you-go pricing model that eliminates the need for upfront investments in hardware and infrastructure. Also, security is always a top priority in banking, and cloud providers offer robust measures, such as encryption, identity management, and access control, to ensure the highest level of protection. With the cloud’s power at their fingertips, banks can confidently leverage AI and machine learning algorithms to gain insights, optimize operations, and deliver unparalleled customer experiences while maintaining top-tier security.

Azure AI, a suite of AI services for developers and data scientists, has played a pivotal role in revolutionizing the BFSI industry with its cloud computing platform, courtesy of Microsoft. By enabling the use of artificial intelligence (AI), Azure has opened up endless possibilities. Users can effortlessly access high-quality vision, speech, language, and decision-making AI models via simple API calls. Additionally, innovative minds can create their own machine-learning models with cutting-edge tools such as Jupyter Notebooks and Visual Studio Code. Furthermore, the availability of open-source frameworks such as TensorFlow and PyTorch has expanded the potential for innovation, with infinite possibilities. Whether it’s a bank looking to harness responsible AI practices or a business seeking to tap into data-driven decision-making, Azure AI offers the flexibility and revolutionary research to make it all happen.

Here’s a list of Azure-AI tools and services that empower the development and deployment of AI solutions.

- Azure Machine Learning: This is a cloud-based service that enables developers and data scientists to build, train, and deploy machine learning models at scale. It offers a variety of features, including automated machine learning, deep learning, and model management.

- Cognitive Services: Azure Cognitive Services provides pre-built AI models that can be easily integrated into applications to perform tasks such as image recognition, speech recognition, language understanding, and sentiment analysis.

- Azure Databricks: This is a fast, easy, and collaborative Apache Spark-based analytics platform that helps data scientists and engineers collaborate on big data and AI projects. It provides a unified analytics platform for data preparation, machine learning, and business intelligence.

- Azure Synapse Analytics: This is an analytics service that brings together big data and data warehousing. It enables users to run complex analytics queries on large datasets and provides a workspace for data preparation, data management, and data integration.

- Azure AI: This is a collection of AI services that includes language understanding, computer vision, decision making, and anomaly detection. These services are designed to help developers build intelligent applications quickly and easily.

Although all this seems fascinating, data migration is the first step in using the cloud. Organizations need a simple, accurate, and repeatable way to move their data into the cloud. However, cloud initiatives can see their progress bottlenecked by manual processes and budget. Migration of Virtual Desktop, Virtual Server, High-Performance Compute, Analytics, and many other critical applications to the cloud requires transferring anywhere from tens of terabytes to several petabytes of file data stored on file servers and NAS appliances and in Object Storage. File data migration between heterogeneous platforms like these requires automated, intuitive, and scalable solutions to eliminate inherent complexity and risk.

Microsoft has made the journey easier by creating the Azure File Migration Program. By supporting the use of Data Dynamics’ StorapeX to migrate data into Azure, Microsoft enables organizations to migrate their unstructured files and object storage data into Azure at zero additional cost and no separate migration licensing. Customers can register their migration project information with Data Dynamics and start moving data today.

StorageX is Data Dynamics’ leading unstructured data migration software delivering automated policy- based data migration. StorageX enables seamless cloud data migration, data center consolidation, and storage optimization to drive intelligent, swift, and secure petabyte-scale unstructured data migrations.

Through this program, Microsoft and Data Dynamics aim to help organizations address some of their most critical challenges in the cloud migration lifecycle, such as cost, speed, talent, and risk.

Click here to know more. Or contact us at solutions@datdyn.com I (713)-491-4298. You can also visit our website at www.datadynamicsinc.com to know more about our unified data management platform – a one-stop solution for Mobility, Analytics, Security and Compliance.