In the fast-paced world of banking, where data is king, optimizing storage infrastructure is crucial. The story of how one bank revolutionized its data management practices will leave you inspired and eager to explore the possibilities. By leveraging cutting-edge technology and intelligent data-driven insights, this bank reduced costs, maximized its data capacity, and improved overall efficiency. Join us on this captivating journey as we delve into the challenges faced, the innovative solutions offered, and the remarkable business impact achieved.

Business Need: Unleashing the Full Potential of Data

Imagine an institution grappling with vast amounts of data scattered across various storage systems. This bank yearned for a solution to optimize its storage infrastructure, utilizing file and object storage applications efficiently. With the goal of reducing costs, increasing usable data capacity, and adopting a pay-as-you-go pricing model, the need for intelligent data-driven migrations was imminent.

Challenges Faced: The Price of Unused Potential

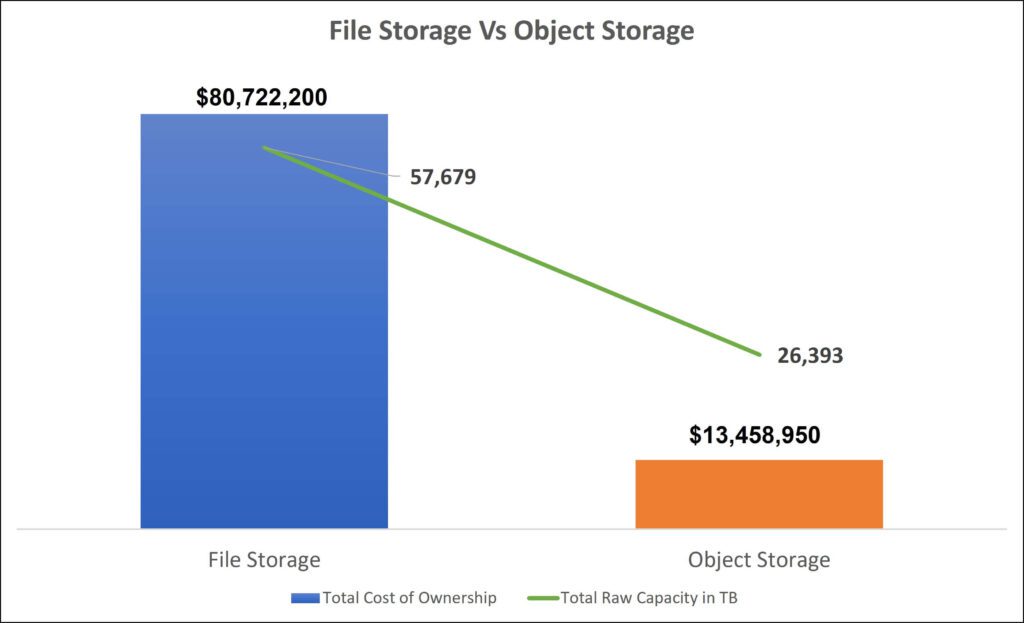

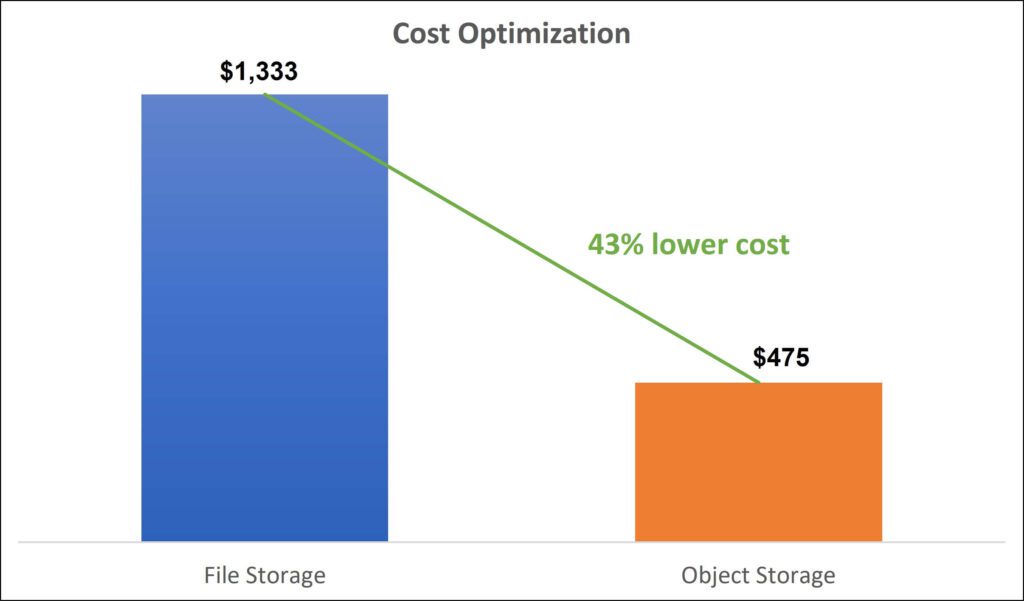

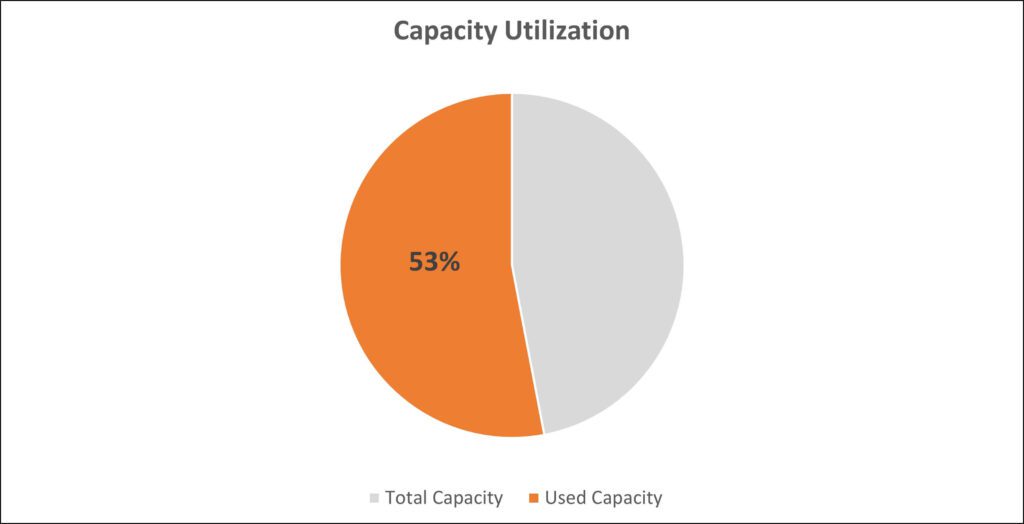

The bank found itself burdened with a staggering total cost of ownership: a whopping $80.72 million for 57,679 terabytes (TB) of data on file storage and an additional $13.46 million for 26,393 TB of data on object storage. Astonishingly, they were utilizing only 53% of their total usable file storage, resulting in a surplus payment of $26.38 million annually for unused storage capacity. The average cost per TB for file storage was $1,333, while object storage cost a mere $475 per TB, presenting an opportunity for significant cost reduction.

The Data Dynamics Advantage: Intelligent and Unified Data Lifecycle Management

Enter Data Dynamics’ Unstructured Data Management platform —a game-changer for this bank’s storage infrastructure. The platform offered an array of robust features that addressed the organization’s pressing needs. Let’s explore some of these transformative capabilities:

- Identification of Data: Analyzing metadata and enhancing control

The first step towards optimizing the bank’s storage infrastructure was to gain a comprehensive understanding of its data. The platform leveraged advanced metadata analysis techniques to discover, classify, tag, and index data sets based on ownership, access, metadata, and content. This process provided valuable insights into the nature and characteristics of the data, enabling the bank to enhance control and security.

Additionally, content analytics provided a single-pane view of sensitive data, allowing the bank to identify high-risk sensitive data and quarantine it in secure storage with limited access. This proactive approach ensured that sensitive information was protected, reducing the risk of data breaches and compliance violations. - Automated Migration of Data: Seamless and intelligent file-to-object migrations

The platform facilitated automated data migrations from file storage to object storage, simplifying the process and minimizing human intervention. One notable feature was the intelligent object sizing capability, which ensured that data was migrated into optimal-sized objects, maximizing efficiency and minimizing storage overhead.

Policy-based migration enabled the bank to execute data migration with unparalleled efficiency, fortified data security, and minimal disruptions. Driven by advanced analytics, the platform delved into the bank’s data, identifying matching shares/exports that necessitated migration. Seamlessly streamlining the movement of SMB/NFS source files across diverse storage resources, automated data movement policies facilitated the frictionless transfer of complete shares or exports to new destinations. Additionally, automated access control security management empowered the bank to modify Security Identifiers (SIDs), remove orphaned SIDs, and preserve SIDs during the file movement process, bolstering data security measures. The inclusion of the cutover estimation feature accurately predicted the time required to migrate the data, providing invaluable insights to guide informed decisions on transitioning users from the source to the new location.

Furthermore, the platform enabled intelligent data placement, ensuring that data was located closest to the applications that required it. This approach not only improved performance but also ensured compliance with data governance requirements and industry regulations. - Automated Access Control and File Security Management: Protecting data at every level

To ensure the highest level of data security, the platform offered automated access control and file security management. Role-based access control ensured that only authorized individuals had access to specific data, minimizing the risk of unauthorized access and data breaches. File re-permissioning allowed the bank to adjust permissions as needed, ensuring that data remained protected throughout its lifecycle.

By automating access control and file security management, the bank could streamline security processes, reduce the burden on IT teams, and maintain a robust and secure data environment. - Proactive Analysis and Policy-Based Tiering: Maximizing Efficiency and Transparency

Data Dynamics’ platform provided the bank with the ability to conduct proactive analysis of its data on an ongoing basis. This allowed them to identify trends, patterns, and opportunities for optimization. By constantly monitoring and analyzing their data, the bank could make informed decisions about resource allocation, storage utilization, and data placement.

Policy-based tiering was another powerful feature offered by the platform. By defining policies based on factors such as data value, access frequency, and regulatory requirements, the bank could automatically determine the most appropriate storage tier for each piece of data. This approach ensured that data was stored in the most cost-effective manner while still meeting performance and compliance needs. - Full Transparency and Environmental Impact: Green and sustainable practices

Data Dynamics’ platform provided the bank with full transparency regarding the physical and logical location of their data. This transparency was crucial for compliance audits, as well as for ensuring data sovereignty and meeting regulatory requirements.

By optimizing its storage infrastructure and implementing intelligent data management practices, the bank was able to avoid new hardware purchases. This not only resulted in significant cost savings but also contributed to a massive reduction in their data center footprint. The environmental impact of these practices added value in terms of sustainability and corporate social responsibility, aligning the bank’s operations with broader environmental goals.

Business Impact: Empowering the Future of Financial Data Management

The implementation of unified data lifecycle management brought about a seismic shift in the way our subject company managed its data. The results were nothing short of impressive:

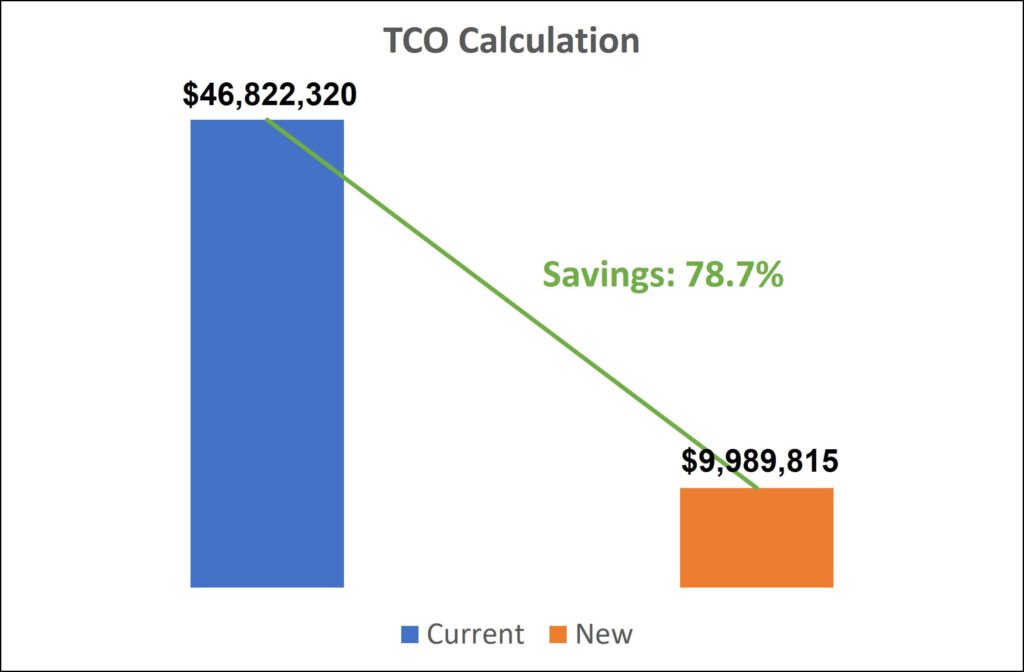

- Cost Savings: The bank realized substantial cost savings by leveraging intelligent data management practices. With the platform’s ability to identify and analyze data, the bank could optimize its storage infrastructure and reduce unnecessary expenses. By migrating data from file storage to object storage, which had a significantly lower cost per terabyte, the bank achieved cost savings of 79.2% within just one year. Additionally, for every terabyte moved to object storage, the bank saved $858, resulting in significant long-term cost reductions.

- Increased Usable Data Capacity: Through the platform’s data migration capabilities, the bank was able to increase its usable data capacity by 29%. By moving data to low-cost object storage for long-term archival or cloud tiering, the bank optimized its storage resources and maximized the amount of data it could store and access. This increased capacity allowed the bank to accommodate growing data demands and improved its ability to support business operations and data-driven decision-making.

- Enhanced Security and Compliance: Data Dynamics’ platform offered robust features for access control and file security management, ensuring data integrity and protection. The automated access control mechanisms and file re-permissioning capabilities enabled the bank to implement role-based access, minimizing the risk of unauthorized data access and data breaches. The platform’s content analytics and data classification also facilitated the identification and quarantine of high-risk sensitive data, ensuring compliance with regulatory requirements and industry standards.

- Improved Efficiency and Productivity: The proactive analysis capabilities of the platform empowered the bank to optimize data management processes and enhance operational efficiency. By constantly monitoring and analyzing data, the bank could identify trends, patterns, and opportunities for optimization. This proactive approach helped streamline storage operations, minimize cutover windows, reduce user downtime, and minimize disruptions during data migrations. With unified data management during migration, the bank maximized user access to data, enabling smooth operations and improved productivity across the organization.

- Environmental Impact and Sustainability: The implementation of Data Dynamics’ platform had significant environmental benefits. By optimizing storage infrastructure and avoiding new hardware purchases, the bank achieved a substantial reduction in its data center footprint. This reduction not only translated into cost savings but also contributed to a greener, more sustainable environment. The platform’s focus on intelligent data placement and policy-based tiering allowed the bank to allocate data to the most efficient storage resources, minimizing energy consumption and carbon emissions. The positive environmental impact added value to the bank’s corporate social responsibility initiatives and its overall sustainability strategy.

When our customer approached us with their specific challenge, little did they know that their partnership with us would unlock a treasure trove of extraordinary business values, surpassing anything they had experienced with traditional data management practices. Thanks to this transformative solution, the bank witnessed significant cost savings, expanded their usable data capacity, fortified their security and compliance measures, and experienced heightened efficiency and productivity. But that’s not all – their data management efforts even contributed to a positive environmental impact, showcasing the platform’s versatility and holistic benefits. These remarkable business values highlight the crucial role of intelligent data-driven strategies in shaping an enterprise’s overall success, ensuring its competitiveness, and promoting sustainability in today’s fast-paced digital landscape. By embracing the power of unified data management, companies can embark on an exciting journey of enhanced performance, streamlined operations, and a data-centric approach that empowers organizations to thrive in the digital era. It’s time to unlock the full potential of your data and revolutionize your business!

Click here to download the case study.

About Data Dynamics

Data Dynamics is a leading provider of unified enterprise data management solutions, helping organizations structure their unstructured data with their Unified Unstructured Data Management Platform. The platform encompasses four modules- Data Analytics, Mobility, Security, and Compliance. Proven in over 26 Fortune 100 organizations, the Platform uses a blend of automation, AI, ML, and blockchain technologies and scales to meet the requirements of global enterprise workloads.

With Data Dynamics, enterprise customers can eliminate the use of individual point solutions with siloed data views. Instead, they can utilize a single software platform to structure their unstructured data, unlock data-driven insights, secure data, ensure compliance and governance, and drive cloud data management. Ultimately, the company’s vision is to help enterprises achieve data democratization so that users, no matter their technical background, can instantly access, understand, and derive maximum insights from unstructured data sprawls.

To learn more, please visit – www.datadynamicsinc.com or contact us at solutions@datdyn.com or call us at (713)-491-4298 or +44-(20)-45520800.