According to a 2021 Deloitte report, 75% of CFOs believed another economic downturn or recession was ahead of them and were not wrong. Keeping this in mind, it was crucial to build an organization that could withstand the impact of a recession. 99% of companies unprepared for the downturn will take the safer route and make the same old mistakes: halt new projects, reduce their expenditures, make brutal layoffs, and cost optimizations wherever possible. Only a few organizations will respond well in this situation and see this as a business opportunity to use their data effectively to maximize efficiency. A recession allows businesses to utilize their data to gain ultimate insights and capitalize on (monetize) the insights (personalized and targeted behavioral and performance actionable insights) hidden in vast amounts of data about customers, offerings, markets, and operations.

However, this is the ideal scenario and requires long-term business strategies. Let’s talk about the burning issue at hand – What is the first and foremost step that organizations can take to optimize their costs?

Intelligent data optimization is the silver bullet.

One of the biggest data management challenges faced by the finance industry today is data storage. The banking sector accumulates a massive sprawl of data daily, of which 80% of the data is unstructured. Banks are required to store their customers’ personal data for a minimum of 10 years. Now, remember that banks acquire new customers daily, leading to data generation. Where can they store their vast amounts of sensitive data? Most financial institutions still depend on legacy infrastructure, which means they store their data on-premise, which is costlier than public cloud storage. Banking and financial institutions keep buying more storage space for their data as it keeps growing exponentially. As the cost of storage increases for companies, so does the cost of maintaining these data centers.

At a time when organizations and enterprises are looking to cut down costs, why are they still paying enormous sums for data residing on on-premise storage? On-premise servers require investments in IT infrastructure and physical infrastructure, including servers, office space, insurance, and electricity and cooling equipment. Additionally, financial institutions, such as banks and credit unions, handle a great deal of sensitive financial information each day. Data security is crucial, especially since a security breach could result in massive lawsuits and reputational damage. It can be expensive and challenging to ensure that physical files are well protected on-site. In other words, even if the bank’s sensitive files are not compromised, they still spend a fortune to protect their data. Today, vast stored unstructured data repositories, called Dark Data, sit dormant because firms lack the tools to harvest their full potential. It is difficult for organizations to stay ahead of future trends, build resistance to market dynamics such as the recession & gain competitive advantage if they do not valorize their data.

Organizing, categorizing, and tagging unstructured data in a way that’s easily searchable in databases allows it to be segregated into hot, cold, ROT and sensitive data. By analyzing data, enterprises can move BLOBs and infrequently accessed data to lower-tier (and lower-cost) and adopt pay-as-you-go storage. Also, cloud-based technologies, often referred to as global file systems or NAS storage replacements, will reap several benefits, such as infinite scalability, faster data retrieval, better data analytics, reduction in cost, and optimization of resources. Structuring unstructured data and tiering it based on usage presents a huge opportunity with four principal applications: reducing costs, fighting cyber threats, improving consumer experience, and adherence to compliance.

Why does the hybrid cloud hold the answer to the questions that enterprises have about the recession?

There is an ongoing debate about whether moving to the cloud is a good idea for financial institutions or not. While some people have security concerns about moving to the cloud, 95% of executives think their current, old legacy systems and technological capabilities prevent them from optimizing their data for customer-centric growth initiatives. Moving to the cloud makes it easier for financial institutions to automate their processes, provide better customer support, and reduce the time required to help a customer. It can also help them adjust to legislation like GDPR and remain compliant with regulatory requirements. Cloud services like Microsoft Azure offer encryption and security protocols to help companies comply with privacy and security regulations.

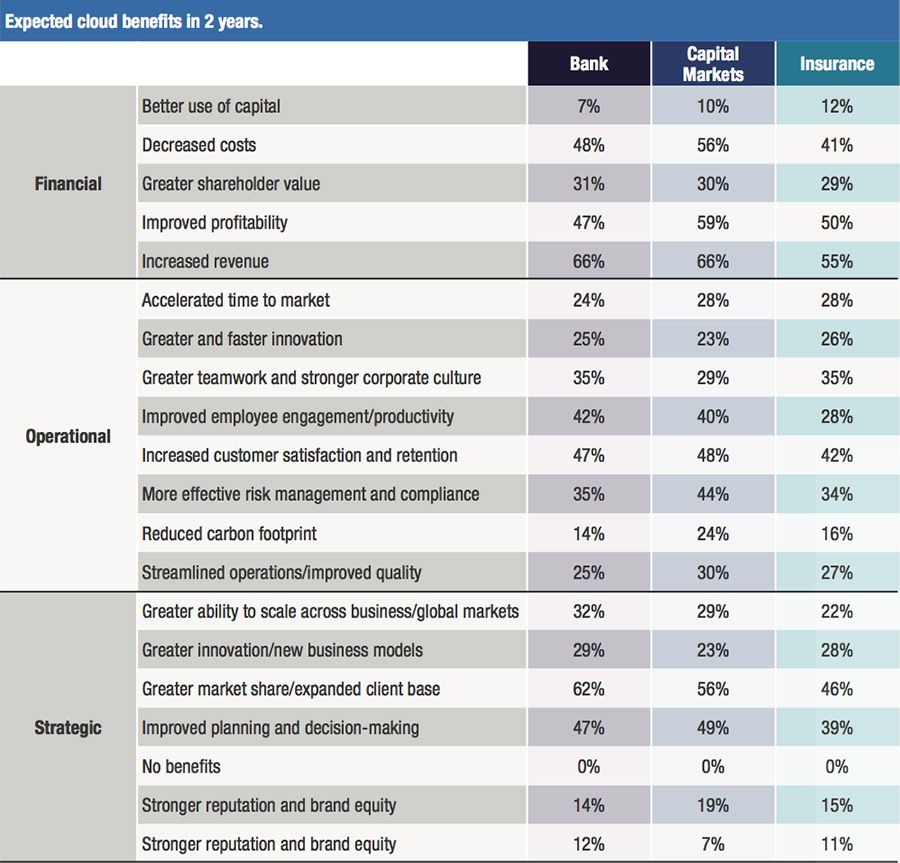

However, the two biggest benefits of hybrid cloud model are lowering costs and increasing profitability. According to a 2022 study by Capco and Wipro, 48% of banks expect cloud computing to lead to decreased costs in the coming two years and 47% think it can boost profitability.

Cloud-based solutions have become more ubiquitous as compared to on-premise as there are no enormous upfront costs in the cloud. The monthly subscription fee is paid on a per-use basis and maintenance, up-to-date software, security and support are all taken care of by the cloud provider. Also, your staff doesn’t have to waste time troubleshooting problems and focus or their core business operations. Most providers include large amounts of storage in their base subscriptions, along with benefits like increased security, file sharing, and all the other perks that come with the cloud.

To ensure efficient and profitable cloud adoption, enterprises must first start by understanding how much data is present in their file storage. Once that is clear, the unstructured data needs to be structured and further categorized into hot or cold data. Once the necessary data has been organized and indexed, hot data can be moved to file storage, while cold data can be transferred to object storage and archived in a space like Microsoft’s Azure Blob or AWS’ S3 storage. Since cold data is not required daily, archiving it would help organizations cut costs without compromising their data security.

The overall cost of using the cloud can often be less than you’d spend on on-premises storage/server use, cooling, floor space, and electricity when data is analyzed correctly before migrating.

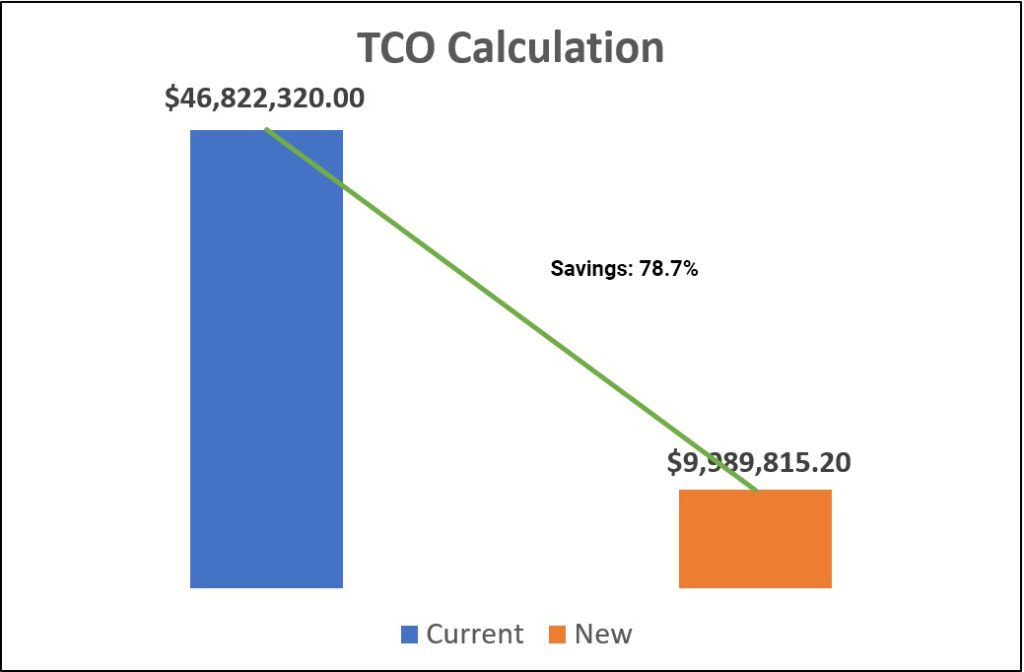

Here’s an example of how a Fortune 200 bank lowered their total cost of ownership by 78.7%with Intelligent Data Storage Lifecycle Management

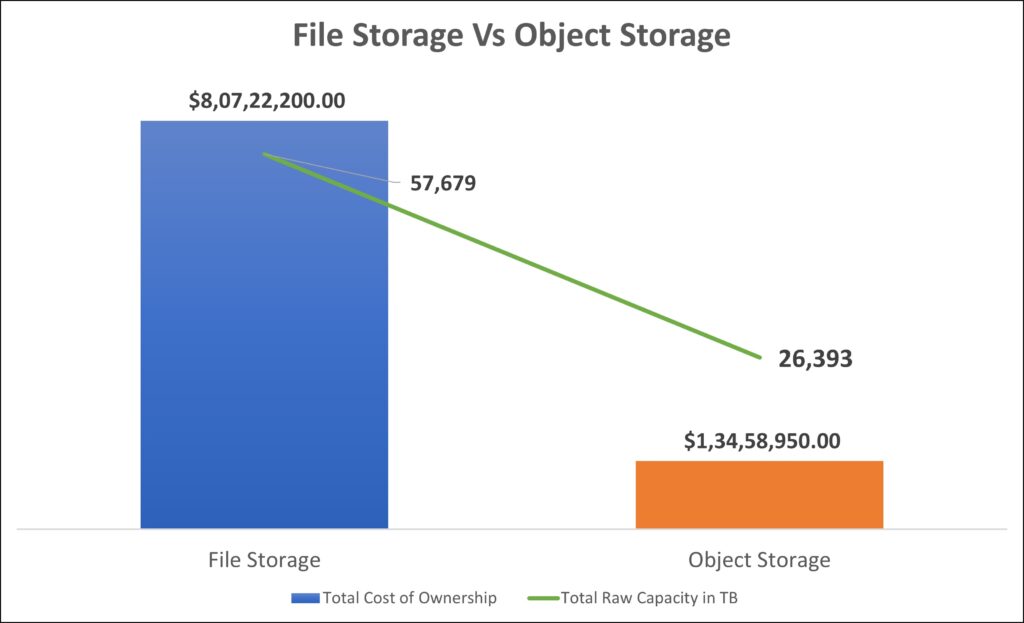

A Fortune 200 bank had three existing file storage applications and two object storage applications. They were suffering from high storage costs because they were underutilizing object storage and piling more data on file storage. Data Dynamics enabled them to optimize their total cost of ownership by intelligently moving data from file to object storage. Here’s how.

1. The bank had a total cost of ownership of 80.72M for 57,679 TB of data on file storage and 13.46M for 26,393 TB of data on cloud object storage.

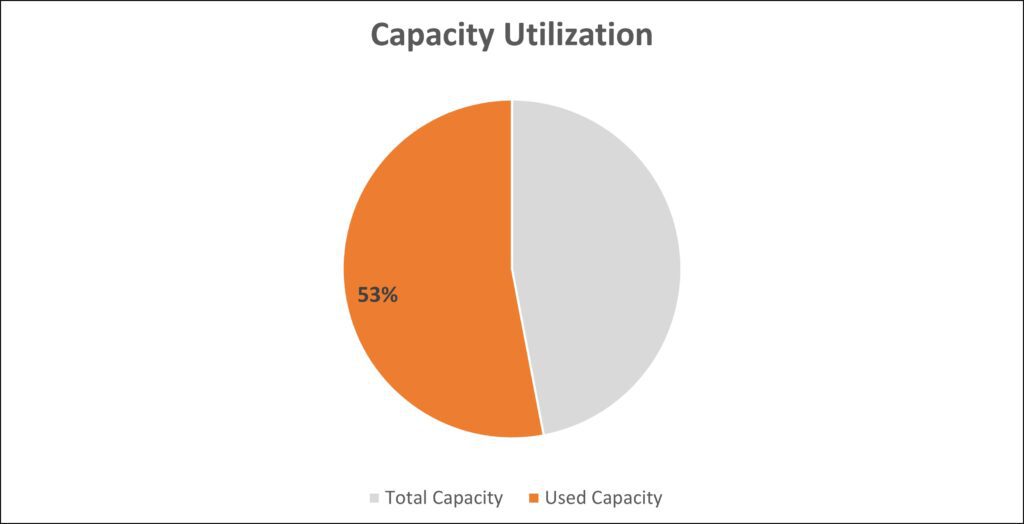

2. They used only 53% of their total usable file storage and paid a surplus of $26.38M yearly for unused storage capacity.

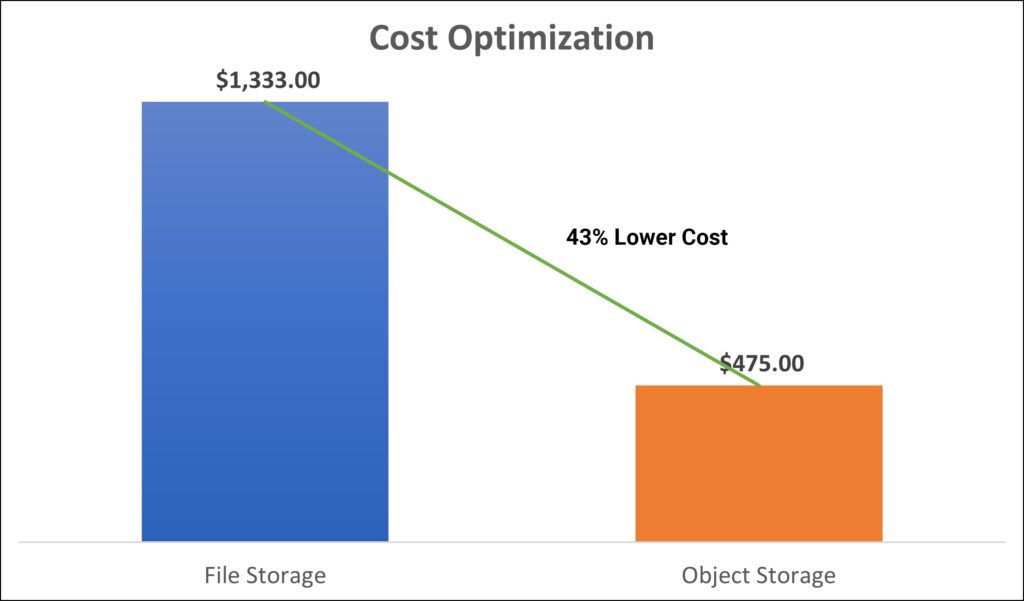

3. The average cost of file storage per TB was $1,333, whereas it was $475 for cloud object storage, i.e., 64% lower than file storage

4. The objective was to move data from file storage to cloud object storage to reduce costs, enable higher capacities of usable data, and ensure pay-as-you-go pricing

- Data Dynamics helped the organization realize a cost saving of 79.2% in one year with intelligent data management.

- For every TB moved to cloud object storage, the bank could save $858 and increase total usable data capacity by 29%.

- Proactive analysis of data on an ongoing basis

- Policy-based ‘Intelligent’ tiering (local and cloud)

- Full transparency on the physical and logical location of data

- Avoid new hardware purchases

- Massive carbon reduction impact (ESG value addition)

- Large reduction in data center footprint

How can Data Dynamics empower enterprises to be recession-proof with intelligent data and storage lifecycle management?

With Data Dynamics’ unified approach to studying data, categorizing it, identifying sensitive information, and archiving it, combined with access control, data quarantining, and immutable audit trails, cloud adoption is quick, efficient, and effective. We are collaborating with leading Cloud service providers to facilitate efficient and effective cloud adoption, reduce risk, ensure compliance, and enable unparalleled scale and compute power. Our goal is to empower enterprise customers to become Data Custodians of the future by structuring unstructured data and maximizing value through data-driven cloud adoption.

As a part of our ‘accelerating cloud adoption’ objective, we have recently partnered with Microsoft Azure to help enterprises migrate data into Azure at zero cost. Now organizations can move their unstructured files and object storage data into Azure without paying a cent or purchasing separate migration licenses. Migrations are automated, ensure minimal risk with automatic access control and file security management and deploy intelligent data management across On-Premise, Azure, and Hybrid Cloud.

Click here to check out how Data Dynamics utilized the Azure File Migration Program to help one of the world’s seven multinational energy “supermajors” Fortune 50 companies accelerate its net zero emission goals while driving digital transformation.

Click here to learn more about the program or reach us at solutions@datdyn.com I (713)-491-4298 I +44-(20)-45520800